With 20.8 million social media customers, it’s estimated round 76% of Australians are actively engaged on social networks.

However how can manufacturers successfully attain these customers? Step one is to take a more in-depth have a look at the social media demographics in Australia. From generational traits to platform preferences, we cowl the must-know particulars about Aussie social customers and their on-line behaviours.

Social media utilization demographics in Australia

As social media continues to evolve, Australians aren’t simply utilizing it to speak with family and friends—they’re utilizing it to remain linked to the world round them. From sporting occasions to social causes, economics to leisure, social media is providing a window into the worldwide traits and occasions Aussies care about.

- Per a 2024 Deloitte report, Australians predominantly use social media to browse feeds, watch movies and message with buddies.

- The report additionally discovered that roughly one in 5 Australians creates social media content material to generate revenue. Gen Z most actively earns cash from social media, with 40% of customers on this demographic utilizing it as an revenue supply.

- Based on The 2025 Sprout Social Index™, 91% of Australian social media customers use it to maintain up with traits and cultural moments.

- The Index additionally stories that 93% of customers say it’s vital for manufacturers to maintain up with on-line tradition by way of their social media accounts.

Social media networks by age group in Australia

Australians are spending their time throughout a spread of social media networks, together with legacy websites and rising platforms. These are the platforms Australians are utilizing essentially the most:

- Based on the Deloitte report, almost all generations—Millennials, Gen X, Child Boomers and Matures—use Fb, YouTube and Instagram essentially the most.

- Nonetheless, the info reveals that Gen Z makes use of Instagram, YouTube and TikTok essentially the most.

- Fb’s recognition appears to be declining with youthful generations—and this pattern is anticipated to proceed. The variety of Australian Fb customers is projected to lower by 47 million customers from 2024–2028.

- Australians have gotten more and more open to decentralised social media networks, similar to Bluesky. In November 2024, Bluesky was listed as Australia’s top-ranked social media app in each Google and Apple’s app shops.

Essentially the most lively technology on social media in Australia

To grasp social media demographics in Australia, it’s worthwhile to study every technology’s engagement. Whereas Australians of all ages use social media, youthful customers are extra lively than their elders. Based on Deloitte, right here’s a snapshot of how a lot time every technology spends on social media per week:

- Gen Z: 10 hours and 5 minutes

- Millennials: seven hours and 45 minutes

- Gen X: six hours and 5 minutes

- Child Boomers: 4 hours and half-hour

- Matures: two hours and 40 minutes

By way of each day use, 56% of respondents mentioned they spend wherever from 1–5 hours on social media every day. For a lot of, as soon as they begin scrolling, it’s arduous to cease: 46% mentioned they commonly spend extra time on socials than initially deliberate.

The report additionally highlighted that Australians have combined emotions about their time spent on social media. Whereas 33% really feel involved, 33% aren’t involved and 33% really feel impartial or declined to share their sentiments.

How authorities insurance policies could change social media demographics

Social media demographics in Australia are anticipated to alter in 2026 and past. In November 2024, the Australian Authorities introduced that it will be setting a minimal age of 16 for social media.

Set to take impact in December 2025, the invoice will cowl networks like Fb, Instagram, Snapchat, TikTok and X. Nonetheless, YouTube shall be exempt, with the federal government citing its major functions as “training and well being assist.”

With this in thoughts, networks topic to the legislation can count on to see their under-16 consumer base fall dramatically. In distinction, YouTube might even see a big uptick in under-16 customers as it is going to be one of many few social media websites they’re allowed to entry.

The ban may additionally form younger folks’s content material preferences on social media for years to return. Whereas short-form content material is at the moment king, particularly on networks like TikTok and Instagram, under-16s will now not have the identical stage of entry to it. As a substitute, they’ll have primarily long-form video content material accessible on YouTube, which may skew their preferences accordingly.

Australian manufacturers seeking to join with under-16s should take the invoice and its potential outcomes into consideration. To achieve this viewers past 2025, they’ll have to discover alternate platforms and monitor altering preferences and behaviours.

How do social media behaviours differ by age group in Australia?

Each technology makes use of social media otherwise. No matter who you’re hoping to market to, it’s essential to grasp these distinctions. Under, we break down the ins and outs of every age group so you possibly can grasp generational advertising.

Gen Z: Spontaneous purchasing and social activism

Nicknamed digital natives, Zoomers have been born into the period of the web. That’s why it’s no shock they’re a number of the most lively social media customers on this planet. Under is a snapshot of how Gen Z is utilizing social media in Australia:

- Per Deloitte, Australian Zoomers spent most of their social media time on Instagram, YouTube and TikTok in 2024.

- Based on the Q1 2024 Sprout Pulse Survey, Gen Z is most probably to make use of social to find new merchandise, sustain with the information and search buyer care from manufacturers.

- Based on The 2023 Sprout Social Index™, Gen Z are impulsive social customers. Over 50% of Gen Z customers make month-to-month or weekly spontaneous purchases because of one thing they noticed on social.

- Whereas Gen Z are discouraged by brand-led activism, they’re obsessed with influencer activism. Almost all Zoomers agree that influencers ought to take public stances on social points.

Millennials: Multitaskers who crave originality

Millennials’ social media behaviours are layered and nuanced. For many Millennials, social media isn’t simply a part of their each day routine—it’s how they begin their day. Nonetheless, whereas they’re digitally invested, they’re additionally simply distracted; many break up their consideration throughout a number of duties and platforms. Moreover, though they’re receptive to social media promoting, it must be genuine and distinctive to resonate.

- The 2024 Deloitte report confirmed that Australian Millennials spent most of their social media time on Fb, YouTube and Instagram in 2024.

- One other 63% of Millennials, in accordance with the report, are extra influenced by social media promoting than different types of promoting.

- Over three-quarters (78%) of Millennials have interaction with media to start out their day, mostly by searching social media (28%), the report confirmed.

- The report additionally revealed that 68% of Millennials often multitask whereas utilizing social media, so manufacturers should prioritise content material that’s immediately compelling and straightforward to eat.

- Millennials worth originality on social media, so corporations ought to give attention to creating distinctive content material fairly than leaping on traits.

Technology X: Responsiveness and threat appreciation

Whereas Gen X customers are most lively on established social media platforms, their expectations are something however conventional. Customers on this demographic are most drawn to manufacturers which are responsive and creatively daring.

- Per Deloitte’s 2024 report, Australian Gen X spent most of their social media time on Fb, YouTube and Instagram in 2024.

- Like Millennials, Gen X worth originality in branded social media content material. Nonetheless, responsiveness to clients is what helps them keep in mind a model essentially the most.

- Gen X respect manufacturers that take content material dangers, appreciating innovation and creativity. Companies that defy expectations of their advertising campaigns are likelier to seize the eye of this demographic.

Child Boomers: Staying loyal to legacy platforms

As a substitute of experimenting with new networks, Child Boomers are sticking with acquainted social websites that assist them keep linked.

- Per Deloitte’s 2024 report, Australian Child Boomers spent most of their social media time on Fb, YouTube and Instagram in 2024.

- In comparison with youthful generations, Child Boomers are far much less more likely to embrace new social media networks. Based on a This fall Sprout Social Pulse Survey, solely 14% of Child Boomers have been on Threads—a below-average adoption fee.

- Child Boomers place important belief in influencers. The Pulse survey discovered that 47% of respondents used influencer suggestions as their fundamental supply of vacation present inspiration. Of all generations, Child Boomers have been the likeliest to say influencers encourage their present concepts.

Fb: Australia’s demographics and utilization

Takeaways

- Though Fb’s largest consumer base is aged 25–34, it’s nonetheless extensively used amongst older demographics. Manufacturers seeking to market to Gen X and Boomers can (and will) nonetheless focus their efforts on Fb.

- As a result of Fb has a near-even gender break up, gender-neutral campaigns have the ability to carry out effectively. Entrepreneurs may also conduct A/B testing to check the efficiency of male and female-centric campaigns.

YouTube: Australia’s demographics and utilization

- Variety of customers: 20.80 million

- Largest age group: 18–34 (over 50%)

- Gender distribution: 51% feminine; 49% male

- Time spent per 30 days: 21 hours and 36 minutes

Takeaways

- The majority of Australian YouTube customers are Millennials and Gen Z. To successfully market to them, manufacturers should think about the content material these generations take pleasure in and combine these into their technique.

- For instance, per Sprout’s 2024 Social Media Content material Technique Report, Gen Z engages essentially the most with long-form video, influencer-sponsored content material and short-form video.

- The common Australian spends over 21 hours on YouTube, signalling recurring use and excessive engagement. Entrepreneurs can capitalise on this by creating episodic sequence or binge-worthy content material that encourages customers to maintain coming again.

Instagram: Australia’s demographics and utilization

- Variety of customers: 13.95 million

- Largest age group: 25–34 (45%)

- Gender distribution: 56% feminine; 44% male

- Time spent per 30 days: 11 hours and 46 minutes

Takeaways

- As a result of Instagram instructions a big portion of Australia’s on-line consumer base, companies can use it to extend model consciousness and attain new audiences.

- With principally feminine customers, Instagram is especially well-suited to corporations in industries like magnificence, vogue, wellness, way of life and parenting.

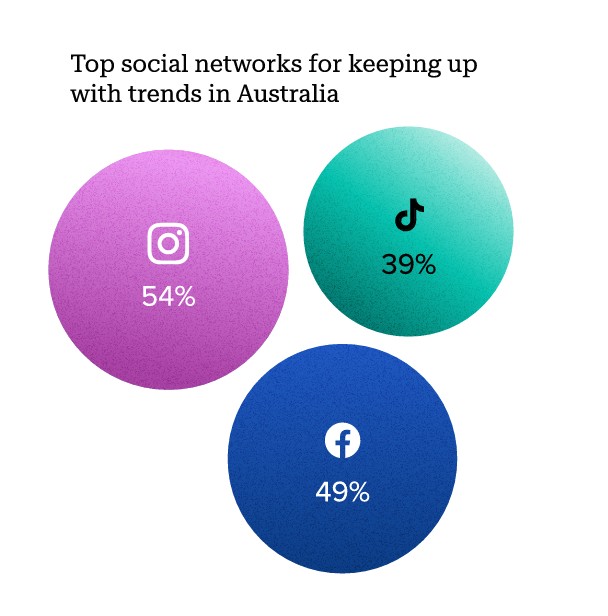

- Per Sprout’s 2025 Social Index™, 54% of Aussie Instagrammers use the location to maintain up with traits. Entrepreneurs want to watch these traits to develop a nuanced understanding of on-line tradition and create content material accordingly.

LinkedIn: Australia’s demographics and utilization

Takeaways

- Month-to-month time spent on LinkedIn is low, signalling extremely intentional utilization. Whether or not it’s to ship connection requests, discover job postings or reply to DMs, it’s protected to imagine that LinkedIn customers have a transparent function when opening the app.

- As such, manufacturers have to prioritise charming copy and high-quality visuals to shortly seize customers’ consideration.

- Based on Sprout’s 2024 Content material Technique Report, customers count on manufacturers to share academic product info, handle smaller communities and supply buyer assist on LinkedIn.

TikTok: Australia’s demographics and utilization

- Variety of customers: 5 million

- Largest age group: Below 24 (over 50%)

- Gender distribution: 51% feminine; 49% male

- Time spent per 30 days: 42 hours and 13 minutes

Takeaways

- TikTok boasts the very best engagement time of any social media web site in Australia, making it a major platform for manufacturers seeking to encourage, educate or entertain by way of short-form video content material.

- TikTok’s largest consumer base is Gen Z. Per Sprout’s 2024 Social Media Content material Technique Report, 77% say TikTok is their favorite community for locating new merchandise. To align with this desire, companies ought to prioritise content material like product launches, unboxings and tutorials.

- The report additionally discovered that 62% of Zoomers use TikTok to hunt buyer care. Manufacturers should guarantee they’re correctly positioned to offer this assist (e.g. promptly replying to DMs and addressing considerations within the feedback).

Snapchat: Australia’s demographics and utilization

Takeaways

- Whereas the app has lengthy been related to teenagers, Snapchat knowledge reveals that just about half of its consumer base is over 25—an indication that customers keep on the app long run. This presents a possibility for manufacturers to evolve their content material as their audiences age and experiment with extra nuanced messaging.

- The identical knowledge reveals that Australian Snapchatters open the app a mean of 40 occasions per day to trade messages, share updates and watch highlights of their favorite reveals. Entrepreneurs can capitalise on these frequent visits by selling bite-sized content material within the Uncover feed.

- Based on Snapchat, 60% of Aussie customers work together with Augmented Actuality (AR) Lenses each day. This provides companies a singular alternative to mix leisure with promotion via filters like digital try-ons.

Pinterest: Australia’s demographics and utilization

Takeaways

- Pinterest isn’t the place Australians go to mindlessly scroll—it’s the place they go to actively plan purchases. Customers who save one thing on Pinterest are 7x likelier to finally purchase it.

- Gen Z is Pinterest’s fastest-growing consumer base. Per Pinterest, they save nearly 2.5x extra Pins and make 66% extra boards than different generations.

- To indicate up in Pinners’ high-intent searches, manufacturers should select hanging visuals (each photos and movies) and inject related key phrases into their titles and descriptions.

- Pinterest’s predominantly feminine consumer base is shaping predicted traits, similar to “Goddess Advanced” and “Sea Witchery” make-up appears to be like.

X (previously Twitter): Australia’s demographics and utilization

- Variety of customers: 4.03 million (projected determine for 2025)

- Largest age group: 25–34 (international)

- Gender distribution: 32.5% feminine; 67.5% male

- Time spent per 30 days: 2 hours and 31 minutes

Takeaways

- As a result of its consumer base principally consists of males, X is a perfect outlet for manufacturers in historically male-dominated sectors, similar to sports activities, tech, gaming and finance.

- X has a singular capability to facilitate real-time conversations and updates, which is a serious drawcard for its Aussie customers. Entrepreneurs can capitalise on this by sharing commentary, thought-provoking questions or culturally related content material.

Social media for information consumption by age group in Australia

Australians, notably these in youthful demographics, are more and more utilizing social media as a information supply.

- Based on a 2024 report, 70% of Australians aged 18–24 use social media to entry information; 46% named social media as their fundamental information supply.

- The report additionally revealed that 64% of Australians aged 25–34 entry information by way of social media; 38% listed social media as their fundamental information supply.

- In distinction, in accordance with the report, solely 22% of Australians aged over 75 use social media as a information supply.

With extra Aussies searching for out their information on social media, concern over misinformation has elevated. Per the College of Canberra, 75% of Australians are frightened about distinguishing truth from fiction on social networks—an 11% improve since 2022.

Social commerce by age group in Australia

Along with performing as a supply of stories and leisure, Australian customers are utilizing social networks to browse, focus on and buy services.

- Roughly 57% of Australians have engaged in social purchasing actions.

- Statista knowledge reveals that Millennials had the very best social purchasing engagement in 2022, adopted carefully by Gen Z.

- Fb was the popular social commerce platform amongst Millennials, while Instagram and TikTok have been extra fashionable with Zoomers, Statista knowledge confirmed.

- In 2025, Millennials are anticipated to account for roughly one-third of social media purchasing worldwide. Zoomers will probably be an in depth second, accounting for 29%.

- Per a 2023 survey, 58% of respondents shopped on Fb, making it Australia’s hottest social commerce web site. YouTube took second place, with 44% of contributors having purchased one thing on the platform.

- In 2023, 40% of Aussie social customers in Australia used Instagram to make purchases.

Utilizing social media demographics in Australia to strategise smarter

By reviewing social media demographics in Australia, you’ll have a greater understanding of your viewers on this nation so you possibly can create a profitable social technique. Whether or not you’re advertising to Gen Z or Child Boomers, these insights will empower you to really join with them.

However analysing social media demographics isn’t a standalone activity. As a result of demographics solely inform a part of the story, you’ll have to pair this knowledge with insights into the viewers’s pursuits and preferences on every platform. Moreover, since these preferences are continuously evolving, it’s vital to hunt out essentially the most up-to-date knowledge accessible.

To study extra in regards to the newest social media preferences in Australia, try the Australian version of The 2025 Sprout Social Index™.